You can lower your taxable income by participating in these tax savings accounts. If you know you’re going to have health care or dependent care expenses, why not pay those expenses with tax-free dollars?

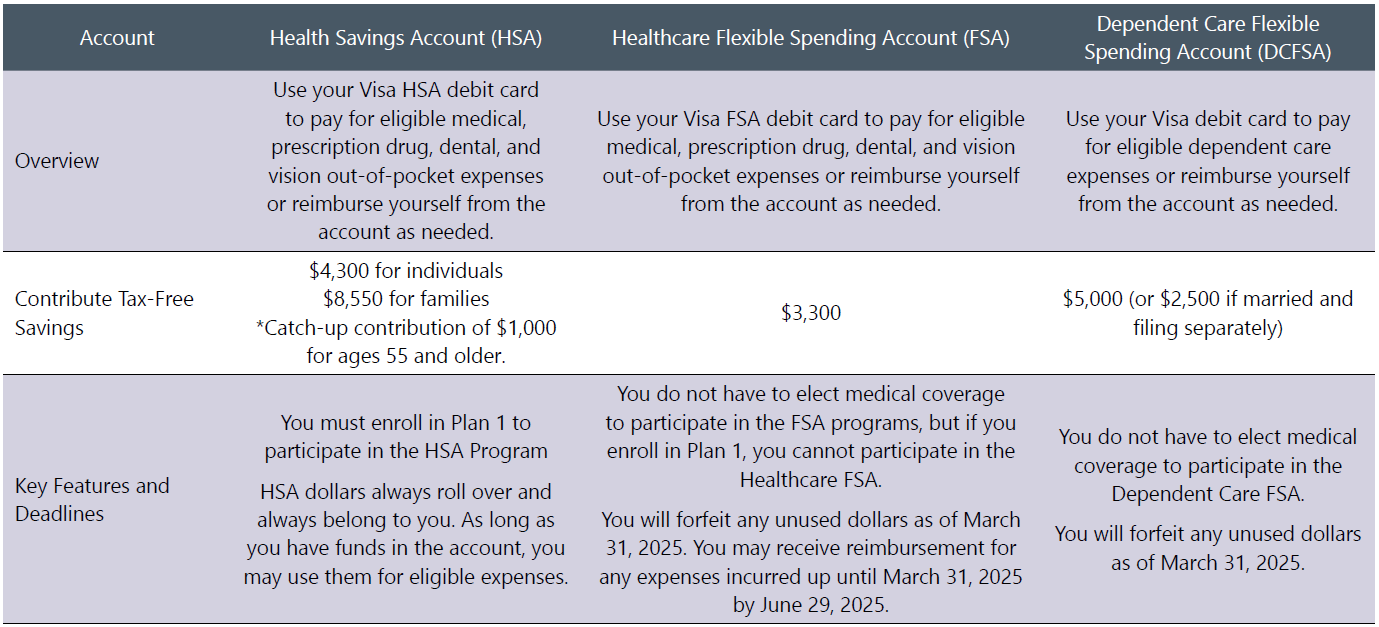

The Savings Account Comparison table describes the key features of the Health Savings Account (HSA) and your Flexible Spending Accounts (FSAs).

In 2025, Inspira Financial will administer Brock’s Health Savings and Flexible Spending Accounts.

Health Savings Account

A Health Saving Account (HSA) is one of the best ways to save for future health care expenses. You decide when to spend this money on eligible health care expenses, and it’s always yours — even if you leave the company.

Additional Information

Healthcare FSA

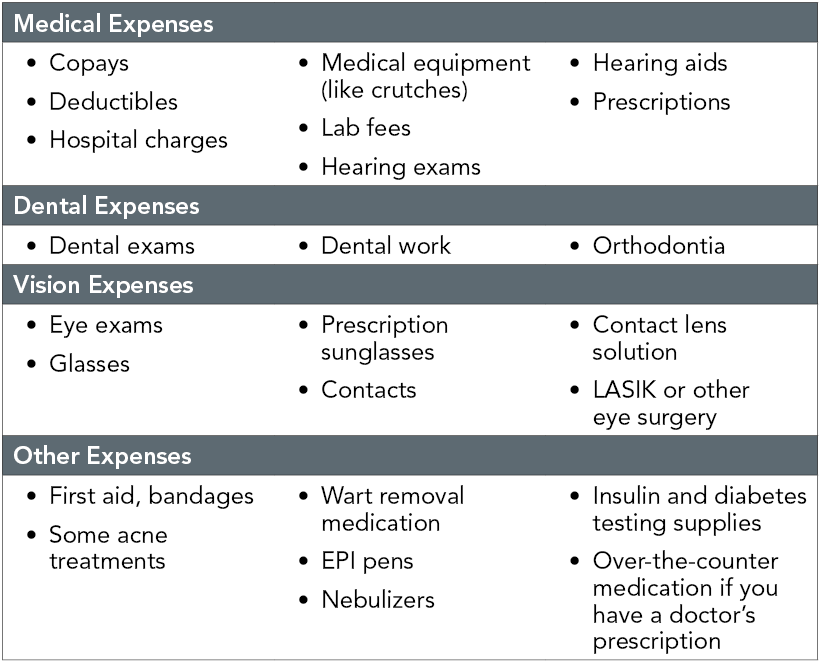

You can contribute up to $3,300 to a Health Care Flexible Spending Account (FSA) with pre-tax dollars and then use your account to reimburse yourself for eligible medical, prescription drug, dental and vision out-of-pocket expenses.

Health Care FSAs are sometimes referred to as “use it or lose it” accounts, as you will lose any Health Care FSA money you don’t use within the eligible period. So plan carefully. FSA dollars do not roll over from year to year.

Additional Information

Dependent Care FSA

You can contribute up to $5,000 to a Dependent Care Flexible Spending Account (FSA) with pre-tax dollars and then use your account to reimburse yourself for eligible dependent care expenses.

Dependent Care FSAs are sometimes referred to as “use it or lose it” accounts, as you will lose any Dependent Care FSA money you don’t use within the eligible period. So plan carefully. FSA dollars do not roll over from year to year.