Brock understands the importance of income protection when you are unable to work because of a disability.

That’s why Brock offers both Short-Term Disability and Long-Term Disability coverage.

Short-Term Disability

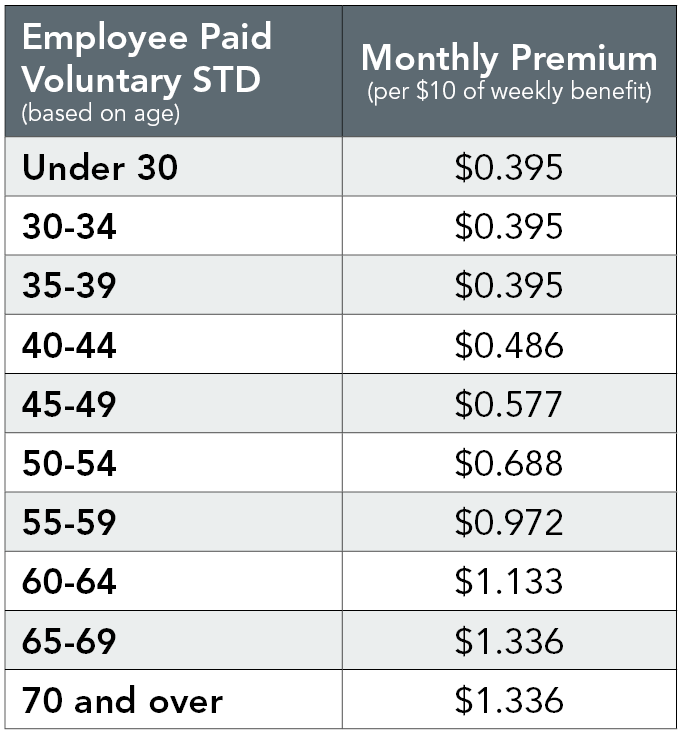

Short-Term Disability (STD) coverage provides income protection if you have an accident or sickness and are unable to work. Your cost for STD coverage is based on your eligible pay and will display when you enroll online. Benefits begin on the eighth calendar day of your disability if you elect this coverage. Some limitations apply. Your STD benefit amount is 60% of pre-disability earnings up to $1,500 weekly. You are eligible for this benefit beginning on the first of the month coinciding with or next following the date you complete 60 consecutive days of employment.

Long-Term Disability

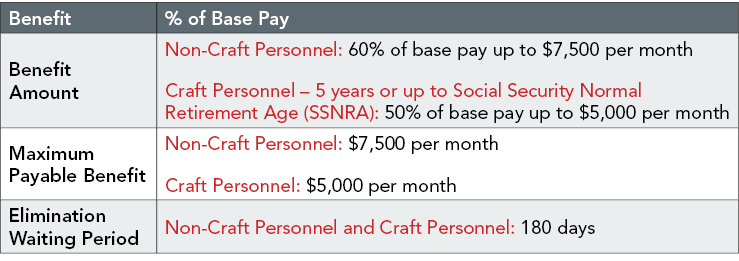

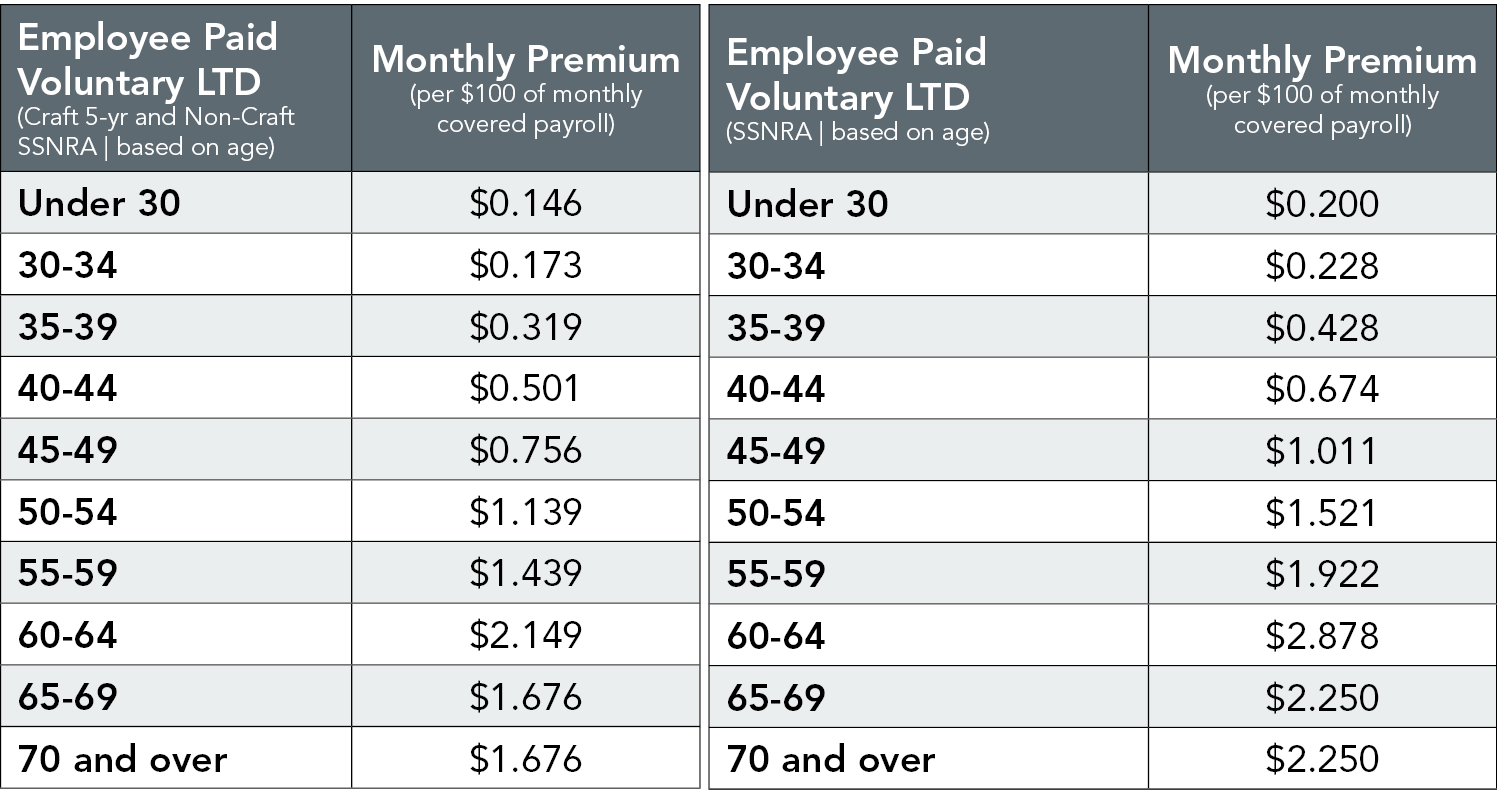

Long-Term Disability (LTD) coverage provides income protection if you become disabled and are unable to work after 180 days of continuous disability. During the enrollment period, you have the option of electing LTD coverage. The cost of coverage is based on age.