You can lower your taxable income by participating in these tax savings accounts. If you know you’re going to have health care or dependent care expenses, why not pay those expenses with tax-free dollars?

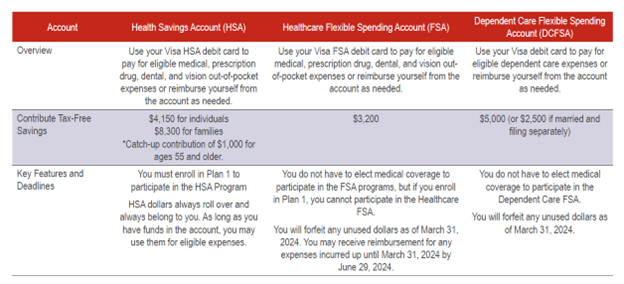

The Savings Account Comparison table describes the key features of the Health Savings Account (HSA) and your Flexible Spending Accounts (FSAs).

In 2024 Inspira Financial will administer Brock’s Health Savings and Flexible Spending Accounts.

Health Savings Account

A Health Saving Account (HSA) is one of the best ways to save for future health care expenses. You decide when to spend this money on eligible health care expenses, and it’s always yours — even if you leave the company.

Additional Information

The HSA is one of the best ways to save for future health care expenses. It provides triple tax protection:

- Money goes in tax-free.

- Money grows tax-free.

- Money comes out tax-free.

If you are able to pay for current medical expenses out of your pocket, you should consider letting your HSA account balance grow tax-free.

To be eligible to make before-tax contributions to an HSA, you must enroll in Plan 1. In addition, you must not:

- Be covered by another health care plan, such as a health plan sponsored by your spouse’s employer, a general purpose Flexible Spending Account, or Medicare parts A, B or D,

- Have received VA benefits within the last three months or be enrolled in Tricare, or

- Be claimed as a dependent on another individual’s federal tax return.

To be eligible to make before-tax contributions to an HSA, you must enroll in Plan 1.

Annual Contribution Limits

The IRS limits the amount of money you can put into your HSA from April 2024 – March 2025:

- $4,150 individual

- $8,300 family

- Additional $1,000 catch-up contribution, if age 55 or older

Contributing to Your HSA

- Your personal contributions are automatically deducted from your paycheck and deposited into your HSA account.

- You can change or stop your contributions at any time.

- You may send in additional contributions up to the IRS annual limits.

- Your HSA will earn interest. Interest rates vary by account balance.

Paying for Health Care Expenses

- Use your debit card provided by Inspira Financial to pay for eligible health care expenses.

- You can also use online bill pay to pay a doctor or hospital bill, or to reimburse yourself for an eligible health care expense that you pay for out of your pocket.

- Save your receipts for your tax records.

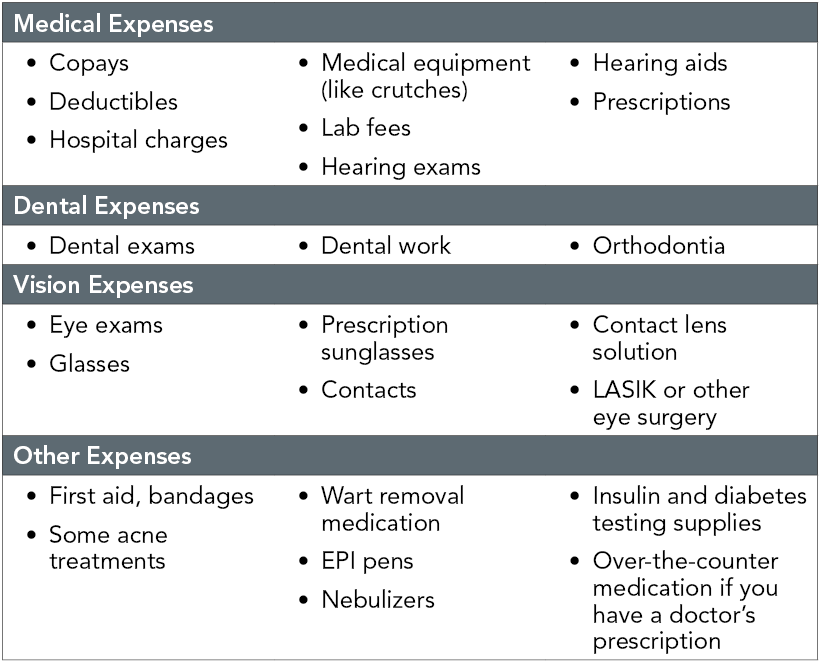

- Remember, the HSA is for eligible health expenses. You will owe tax on ineligible withdrawals, plus a 20% penalty if you are under age 65 and use your HSA for expenses that are not related to your health.

Healthcare FSA

You can contribute up to $3,200 to a Health Care Flexible Spending Account (FSA) with pre-tax dollars and then use your account to reimburse yourself for eligible medical, prescription drug, dental and vision out-of-pocket expenses.

Health Care FSAs are sometimes referred to as “use it or lose it” accounts, as you will lose any Health Care FSA money you don’t use within the eligible period. So plan carefully. FSA dollars do not roll over from year to year.

Additional Information

- You choose the amount you contribute each year – up to a maximum of $3,200.

- Before-tax contributions are deducted from your paycheck in equal amounts during the year and deposited into your FSA account.

- The elections you make will be in effect for the rest of the calendar year and cannot be changed unless you experience a qualifying life event. If you have a qualifying life event, you may stop, start or change the amount of your contributions to your Health Care FSA.

- You will receive a debit card in the mail after you first enroll in the Health Care FSA.

- You can use this card when you visit your doctor, pharmacy or other network providers to pay for eligible health care expenses with your FSA funds.

- In some instances, you may wait for the doctor to file a claim to see how much you owe and then use your FSA to pay any amount due.

- In some instances, you may have to submit a paper claim for expenses incurred during the plan year.

- Complete a Health Care FSA Claim Form and send the form with itemized receipts to the address on the form. Be sure to submit all claims for reimbursement by June 29, 2025.

Dependent Care FSA

You can contribute up to $5,000 to a Dependent Care Flexible Spending Account (FSA) with pre-tax dollars and then use your account to reimburse yourself for eligible dependent care expenses.

Dependent Care FSAs are sometimes referred to as “use it or lose it” accounts, as you will lose any Dependent Care FSA money you don’t use within the eligible period. So plan carefully. FSA dollars do not roll over from year to year.

Additional Information

- You choose the amount you contribute each year — from $50 to a maximum of $5,000.

- Before-tax contributions are deducted from your paychecks in equal amounts during the year and deposited into your FSA account.

- The elections you make will be in effect for the rest of the calendar year and cannot be changed unless you experience a qualifying life event. If you have a qualifying life event, you may stop, start or change the amount of your contributions to your Dependent Care FSA.

- You must pay your provider and then complete and submit an FSA Dependent Care Claim Form for reimbursement.

- You will be reimbursed only up to the actual amount you have deposited into your account.

- If your claim is more than the funds available, you will be reimbursed for the rest of the amount once there are additional funds available in your account.

If you are married, both you and your spouse must work or your spouse must be a full-time student. In addition, you must be the custodial parent or guardian, and the dependent must reside with you for the greater portion of the year while you and your spouse (if applicable) work or are seeking employment or if you or your spouse are disabled or a full-time student for at least five months during the year.